Pre-Qualification vs. Pre-Approval: Is there a Difference?

As you prepare to apply for a mortgage and start the home buying process, you'll come across terms such as "prequalification" and "preapproval". A lot of times these terms are used interchangably, when they are not synonymous. It's extremely important to understand what these terms mean because they will help guide your home search as well as help you focus on homes you can afford.

Every Lender, Mortgage Broker or Loan Officer is Different

At the most basic level, prequalification and preapproval are two different types of mortgage approvals and they refer to the steps a particular lender takes to qualify a borrower for a purchase such as a home. A few things to remember:

- Every lender handles mortgage approvals differently

- Neither is a guarantee that you'll close the loan

What is a Mortgage Pre-Qualification?

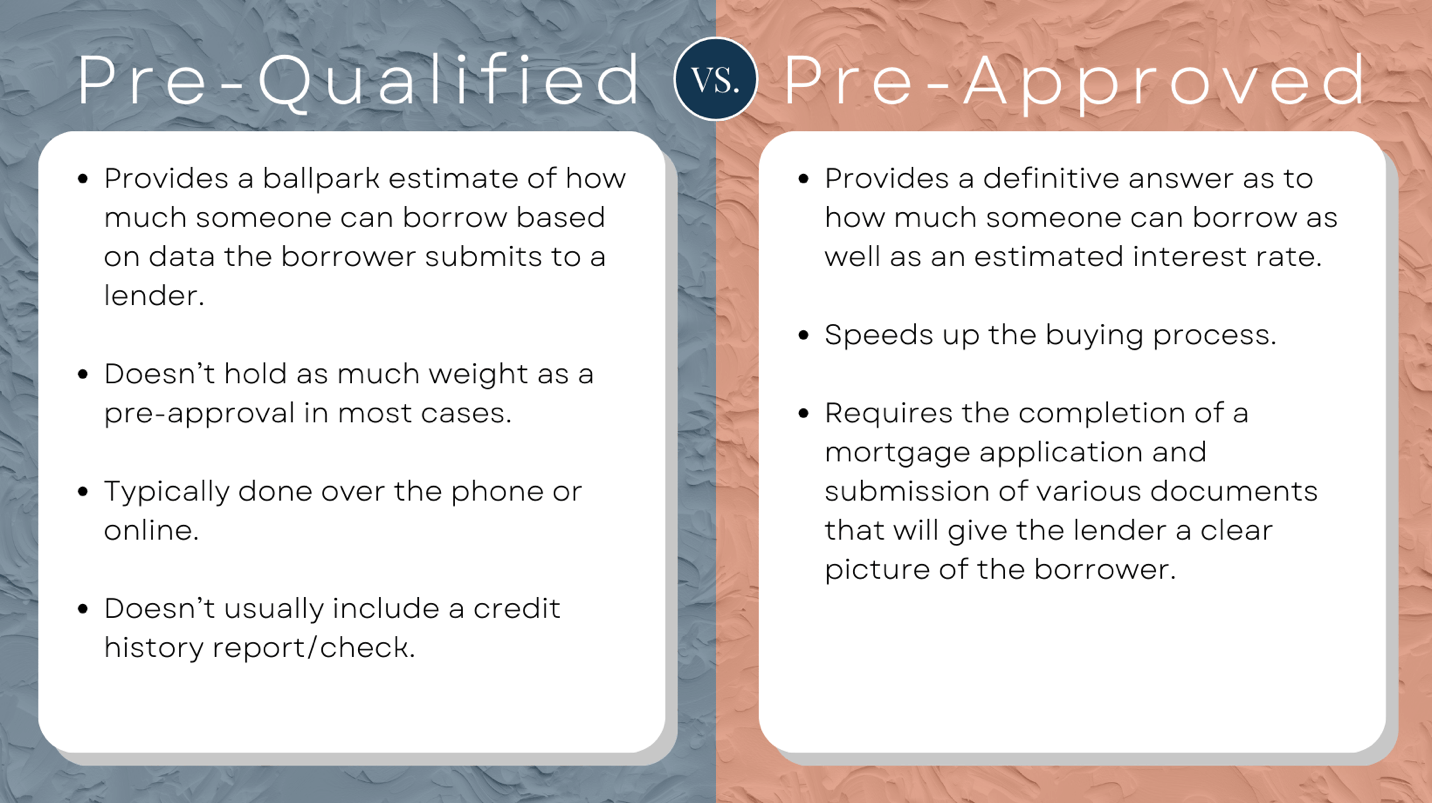

Generally in the pre-qualification phase, you describe your credit, debt, income, etc. And based on this overall financial picture, the lender estimates how much you may be able to borrow. Some lenders also do a credit check, but again this depends on the lender.

In a lot of cases as pre-qualification can be done over the phone or online without verifying any of your information - which is why you only really get a ballpark estimate of what you could be approved for.

You've probably gotten a letter in a mail from a random, major credit card company stating"You're Pre-Qualified!" for a new card - they most likely got your information online somewhere, took a look at what they had access to, and pre-qualified you in hopes you get your business. Mortgages aren't exactly like this, but this is a good example of how certain qualifications can hold more weight than others.

What is a Mortgage Pre-Approval?

A mortgage pre-approval is taking your application process to the next level. Pre-approval requires your to provide proof of your financial history and stability, your debts, credit background and more. The lender will verify your employment, take copies of your last two paystubs (or tax returns if applicable).

If you satisfy the requirements, your loan officer will get you a pre-approval letter with either the value you are approved for or the address of a particular home. It will also include the type of mortgage along with a few terms if applicable.

What's the Difference? and Final Takeaway

Getting pre-qualified can be a great step if you're not quite ready to buy, but have plans to in the future and just need to know where to start. Usually, a pre-qualification can give you can idea of what you can afford without submitting your documents and pulling your credit multiple times. However, if your plan is to start looking at homes now and be able to write an offer at the drop of a hat, a pre-approval would most likely be a better option.

As always, this is not financial advice and it's recommended to reach out directly to a mortgage professional when you have questions or concerns regarding a mortgage approval. Feel free to reach out to me directly if you would like local recommendations.

Categories

Recent Posts

GET MORE INFORMATION